Credit Risk Assessment

- Credit Risk Assessment

- What is a Credit Risk Assessment

- Why Credit Risk Assessments Matter for Businesses

- Key Components of a Business Credit Risk Evaluation

- Sources of Credit Information

- Credit Scoring and Rating Models

- Credit Risk Mitigation Strategies

- Monitoring and Ongoing Risk Management

- Technology and Automation in Credit Assessment

- Challenges in Credit Risk Assessment

- How EntityCheck Helps Your Business with Credit Risk Assessments

If your business offers credit or loans to customers, it’s imperative to put each one through a rigorous credit risk assessment to protect your investment and verify your borrower’s ability to repay the debt. For certain industries, such as banking, credit risk assessment is a legal requirement.

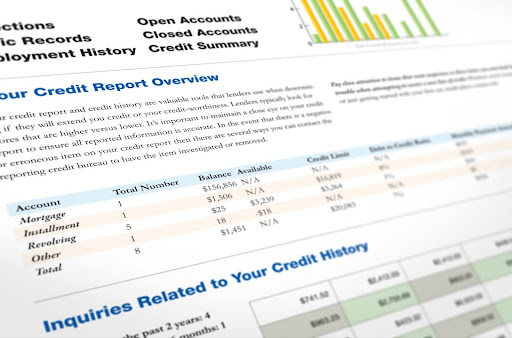

What is a Credit Risk Assessment

A credit risk assessment is the process of evaluating a potential customer, partner, or supplier and their ability to repay a debt or credit. It involves analyzing various factors related to the borrower’s financial health, payment history, and overall risk profile to determine their creditworthiness. A robust credit risk assessment program can help your company make informed decisions about lending, setting interest rates, or managing potential losses.

Some types of businesses that lend money:

- Financial Institutions:

Banks, credit unions, and mortgage companies offer a range of products, including bank loans, credit cards, mortgages, business loans, and lines of credit.

- Lenders:

Specialized lenders may also offer consumers money for collateral. These lenders exist both online and in person. These may offer special products such as SBA or VA loans.

Business types that offer financing:

- Retailers:

Many retailers offer branded credit cards or partner with companies that provide financing options for their customers. A good example would be an Amazon or Macy’s card.

- Fintech Companies:

Companies like PayPal and ViaBill offer “buy now, pay later” services, allowing customers to make payments over time and use their credit at popular online stores.

- Car Dealerships:

Many car dealerships offer in-house financing for car loans. They may also offer third-party financing with other banks.

- Other Businesses:

Often, household services such as landscaping, carpentry, and auto care may provide funding or special payment terms to their customers. They, too, may use a third-party lender to provide this to clients.

Financing options include credit cards, loans, lines of credit, trade lines of credit (for vendors or suppliers), and merchant cash advances.

Why Credit Risk Assessments Matter for Businesses

In business, receiving payment for your products and services is crucial to your success. Credit risk management is the key to avoiding doing business with individuals and companies that are likely to default on their payments. Business loan risk assessment is the process of categorizing potential clients into a specific business credit profile, indicating whether they are a risk or not. Some of the benefits of performing a creditworthiness analysis on everyone you do business with include:

Key Components of a Business Credit Risk Evaluation

A comprehensive business credit risk evaluation involves assessing many factors to determine the likelihood of a borrower repaying a loan or fulfilling their financial obligations. The basic process involves identifying, measuring, and mitigating credit risk, as well as compliance and reporting.

The key components of a business credit risk evaluation include:

- Risk Identification: This involves recognizing all possible risks associated with extending credit to a business, including those related to the borrower's financial situation, market conditions, and industry trends. It also involves determining how much risk your company is willing to accept. You may formalize this in a Risk Appetite Statement (RAS). Another crucial step is evaluating the impact of potential losses from a single borrower or multiple borrowers.

- Risk Measurement and Analysis: This step involves analyzing financial statements, evaluating the borrower’s balance sheets, income statements, and cash flow statements to assess their financial health and the probability of repayment. Utilize credit risk models and credit scoring models to evaluate the borrower’s creditworthiness based on their credit score. You can access credit ratings for companies through various means. Review the borrower’s payment history with other creditors to gauge their reliability. Evaluate the specific risks associated with the borrower’s industry, such as market volatility, competition, and regulatory changes that might affect their ability to repay.

- Risk Mitigation: Risk mitigation is developing documented guidelines for extending credit, monitoring performance, and managing defaults. Require collateral to secure loans and provide a backup source of repayment in case the borrower defaults on the loan. Determine appropriate and safe credit limits based on the customer’s creditworthiness and risk assessment. Spread the credit risk across multiple borrowers to avoid over-concentration of risk. Regularly monitor and review the borrower’s financial performance and payment behavior to ensure risk control.

- Risk Governance and Reporting: With this step, you establish clear roles and responsibilities, defining who is responsible for credit risk management within your organization. Implement systems for tracking and reporting credit risk profiles, and develop automated systems to facilitate this process. Conduct regular performance reviews of credit risk management processes and performance. Identify areas where you can streamline processes and improve workflow efficiency. Evaluate the impact of adverse economic conditions and how they may affect your company.

By carefully considering these components, businesses can make informed decisions about extending credit, manage their credit risk effectively, and minimize potential losses.

Sources of Credit Information

The primary sources of business credit information are the major credit bureaus: Dun & Bradstreet, Equifax, and Experian. These bureaus collect and compile data on businesses to create credit reports and scores, which lenders and other companies use to assess creditworthiness. Some sources for credit information to include in your credit risk assessment program are:

You can also check the internet, press releases, and self-reported information from the company itself, as well as social media.

Understanding these sources of business credit information is crucial for businesses to manage their creditworthiness and make informed decisions.

Credit Scoring and Rating Models

Business credit scoring and rating models are systems used by financial institutions, vendors, suppliers, and insurance companies to assess a company's financial health, creditworthiness, and overall risk. To understand these models, let’s first discuss a business credit score.

What is a Business Credit Score?

A business credit score is a numerical representation of a company's credit risk, typically ranging from 1 to 100, though specific scoring models may use different scales. A higher score indicates a lower risk of late payments or default, making the business more attractive to potential lenders, suppliers, and partners.

Business Scoring Models

Dun & Bradstreet (D&B) offers various scores, with the most common being the PAYDEX Score (1-100), which specifically measures a business’s payment performance and reflects the likelihood of timely payment to vendors and suppliers. D&B also offers the Financial Stress Score, Delinquency Predictor Score, and other ratings.

Equifax provides various scores, including the Business Credit Risk Score (101-992), which predicts the likelihood of severe payment delinquency, and the Payment Index Score (1-100), based on past payment history. Equifax also offers the Business Failure Score.

Experian offers the Intelliscore PlusSM model (1-100), which uses over 800 variables to assess the risk of delinquent payments or default. A higher score indicates lower risk.

FICO Small Business Scoring Service (SBSS), while not a credit bureau itself, FICO SBSS (0-300) uses data from D&B, Equifax, and Experian to generate a score, frequently used for SBA loan decisions.

Factors That Influence Business Credit Scores

Some factors that influence business credit scores include the following:

Companies with better credit scores gain access to more favorable financing terms, stronger vendor and supplier relationships, lower insurance premiums, and better overall business partnerships.

Each credit bureau uses its own methodology for credit scoring for businesses, so scores may vary widely.

Credit Risk Mitigation Strategies

Lenders employ various risk mitigation strategies to minimize the potential for financial loss resulting from a borrower’s failure to repay a loan or fulfill other credit obligations. These strategies are to reduce the impact of credit risk on a lender's financial stability and profitability.

Some credit risk mitigation strategies lenders use include:

Monitoring and Ongoing Risk Management

One of the key aspects of success in credit assessment is a comprehensive program of monitoring and ongoing risk management, which necessitates robust procedures in place. It involves a system of monitoring and ongoing risk management, which is a continuous process of identifying, assessing, and mitigating potential threats to your organization's operations, assets, or reputation. It involves tracking and evaluating risk factors, as well as the effectiveness of implemented risk mitigation measures. This proactive approach helps organizations stay ahead of potential problems and avoid costly mistakes.

Technology and Automation in Credit Assessment

Companies are increasingly relying on technology and automation to revolutionize credit assessment, enabling faster, more efficient, and potentially more accurate evaluations of borrower creditworthiness. These technologies include artificial intelligence (AI), machine learning (ML), and data analytics, which enable the processing of vast amounts of information and automate decision-making processes.

Some of the benefits of using technology for credit assessments include:

- Automated Credit Scoring:

Automated systems use algorithms and machine learning to analyze applicant data, including financial history, credit reports, and other relevant information, to predict the likelihood of loan default. AI can sift through millions of data points in a fraction of a second, eliminating the need for manual data entry and processing, significantly speeding up the credit assessment process. AI-powered systems can analyze more data points, including alternative data like utility payments and social media activity, to provide a more comprehensive view of a borrower's financial health.

- Enhanced Accuracy and Reduced Bias:

Automated systems eliminate human subjectivity from the assessment process, resulting in more consistent and data-driven decisions. AI algorithms can identify patterns and trends in data that might be missed by human underwriters, leading to more accurate risk assessments. By standardizing the process, automation helps reduce the risk of discriminatory lending practices.

- Increased Speed and Efficiency:

Automated systems can process credit applications in a fraction of the time it takes for manual review, leading to faster loan approvals. This efficiency enables lenders to process a larger volume of applications and potentially serve more customers in a shorter timeframe. Streamlined data collection and processing free up human resources to focus on more strategic tasks.

- Improved Risk Management:

Technology and automated systems can identify potential risks more effectively by analyzing large datasets and identifying emerging credit risks. Lenders can adapt their lending strategies based on the insights provided by automated systems, leading to enhanced risk management. By automating various aspects of the credit process, such as communication and document management, lenders can further improve their risk mitigation strategies.

- Cost Reduction:

The use of automation reduces the need for manual labor, leading to lower operational costs for lenders. These cost savings can potentially be passed on to borrowers in the form of lower interest rates or fees.

As with many industries, technology and automation in credit assessment are transforming the financial services industry by making the process faster, more efficient, and more reliable. This benefits both lenders and borrowers by enhancing access to credit and mitigating the risks associated with lending.

Challenges in Credit Risk Assessment

Any credit risk assessment program faces several challenges, including data quality and availability, regulatory changes, evolving market conditions, and the need for skilled and well-trained personnel. Other threats, such as borrower risk, cybersecurity threats, and economic downturns, can also significantly impact the assessment process.

Some detailed challenges in credit risk assessment include:

- Data Quality and Availability:

Accurate and timely data is crucial for effective credit risk assessment. However, many institutions struggle with inconsistent, incomplete, or outdated data, which makes it difficult to assess a borrower’s creditworthiness accurately. Depending on where you obtain your data, it may be more or less accurate.

- Date Security and Privacy:

Another important aspect of collecting personal and sensitive data is that it’s your responsibility to protect it from breaches and ensure borrower privacy, especially as financial services move online.

- Regulatory Compliance:

The financial industry operates within a constantly evolving regulatory system, subject to new rules and requirements. Staying up-to-date and adapting to these changes is a significant challenge. Adhering to these regulations can be complex and time-consuming, adding extra steps to the assessment process.

- Market and Economic Factors:

The financial industry is subject to constant flux, with market conditions changing rapidly and frequently. This makes it challenging to predict future outcomes and accurately assess risk. Economic downturns can lead to increased default rates and deteriorating credit quality, making risk assessment more complex and necessary.

- Human and Operational Factors:

Credit risk management requires a diverse set of skills, including statistical modeling, data analysis, and risk assessment. The shortage of qualified professionals can hinder the effectiveness of the process. Plus, inadequate or flawed internal processes, people, or systems can lead to disruptions and losses in credit risk management.

Finding the right balance between attracting borrowers with competitive interest rates and mitigating potential losses is a constant challenge.

How EntityCheck Helps Your Business with Credit Risk Assessments

EntityCheck delivers comprehensive business data that we have compiled from government, public, and private sources. Our reports include multiple sections with dozens of data points. You’ll find detailed Secretary of State records, such as Articles of Incorporation, annual filings, ownership changes, and entity classifications. UCC filings that cover equipment, vehicles, inventory, accounts receivable, and real estate. License status and expiration details are included if a business requires professional licensing, such as in law, real estate, dentistry, or skilled trades. Court-related data is also available, including lawsuits, bankruptcies, liens, judgments, and federal cases. You can also see information about trademarks, patents, company officers, employees, and their background information.

- Credit Risk Assessment

- What is a Credit Risk Assessment

- Why Credit Risk Assessments Matter for Businesses

- Key Components of a Business Credit Risk Evaluation

- Sources of Credit Information

- Credit Scoring and Rating Models

- Credit Risk Mitigation Strategies

- Monitoring and Ongoing Risk Management

- Technology and Automation in Credit Assessment

- Challenges in Credit Risk Assessment

- How EntityCheck Helps Your Business with Credit Risk Assessments