Anti-Money Laundering (AML) Compliance

- What is Money Laundering?

- What is Anti-Money Laundering?

- The History of Anti-Money Laundering

- What is Anti-Money Laundering (AML) Compliance?

- Why AML Compliance Matters

- AML Compliance Core Requirements (KYC, CDD, EDD)

- BSA and FATF Recommendations

- Key Components of an AML Program

- Identifying and Reporting Suspicious Activity

- Implementing a Risk-Based Approach (RBA)

- Leveraging Technology and Tools

- Consequences of Non-Compliance

- Building a Sustainable AML Culture

- How EntityCheck Can Help AML Compliance

Money laundering is a massive problem for the U.S. and other countries. Criminals use various methods to conceal cash operations and obscure the origins of the money by using legitimate sources to "clean it." Global governments have developed anti-money laundering laws to force companies to put customers, vendors, businesses, and employees through strict compliance tests to reduce the opportunity for money laundering.

What is Money Laundering?

Money laundering is the process that criminals use to conceal where their money comes from and divert it, so it appears to come from legitimate businesses. These organizations take "dirty" money that comes from drug trafficking, fraud, or corruption and "clean" it by filtering it through other companies they own or are affiliated with. It can be a painstaking process that takes strategy and time. Money laundering itself is a type of financial crime.

How Money Laundering Works

Money laundering is a complex system of filtering money through legitimate businesses to disguise its origin. Since criminal groups often make large quantities of money through illegal activities, they may use multiple tactics to launder it. The purpose of money laundering is to use the money they earned through criminal activity without attracting suspicion or investigation from tax or law enforcement authorities. By cleaning money, they avoid the risk of seizure of their money or goods. They also use it to legitimize criminal enterprises.

The process of money laundering works as follows:

- Criminals make small deposits into business bank accounts or use money mules to move funds. They may also purchase assets with the money, converting the funds into value such as precious metals (gold, silver, etc.). Deposits over $10,000 are reported to the IRS, so often, bad actors will deposit $9,999 instead.

- Along with deposits, criminals may also convert the funds multiple times using various financial transactions to bury the original source. Sometimes, they transfer funds between bank accounts or use shell companies to invest in assets that exist only on paper.

- Once cleaned, the organization is free to invest the money in real estate, businesses, or luxury items.

Consequences of Money Laundering

Money laundering is a serious crime with significant consequences for individuals, businesses, and society as a whole. Some of the consequences include:

What is Anti-Money Laundering?

Anti-money laundering is a comprehensive collection of laws, rules, practices, and guidelines designed to identify money laundering and apprehend the culprits. The goal is to determine the origins of the money and trace it back to the original criminals and the crime that produced the revenue.

The History of Anti-Money Laundering

In 1970, the United States enacted the Bank Secrecy Act (BSA), which was one of the first anti-money laundering laws. The BSA was designed to detect and prevent money laundering. Since then, the Financial Crimes Enforcement Network (the designated administrator of the BSA) has amended the act and added additional laws to protect against money laundering and other financial crimes.

In 1989, various countries and organizations formed the Financial Action Task Force (FATF) to create and promote international anti-money laundering standards and practices. After 9/11, the FATF added AML compliance laws to strengthen its position further. One hundred and eighty-nine countries banded together to create the International Monetary Fund (IMF) to ensure the stability of the international monetary system.

What is Anti-Money Laundering (AML) Compliance?

Within the U.S. Department of the Treasury is a division called the Financial Crimes Enforcement Network (FinCEN). This bureau establishes anti-money laundering regulations. Financial institutions like banks, investment firms, and even insurance companies are required by law to follow AML laws and institute practices to remain compliant.

These laws are designed to detect, prevent, and report any financial crimes to the U.S. government with a special interest in money laundering and terrorism financing. Financial institutions’ compliance is not optional. AML regulations demand that banks and other financial companies follow strict rules when taking on new customers, vendors, partners, and employees.

Why AML Compliance Matters

AML compliance is crucial for many reasons. Not only does it help protect the financial organization’s reputation and build trust with customers, but it also does the following:

AML Compliance Core Requirements (KYC, CDD, EDD)

Know Your Customer (KYC)

Know Your Customer practices help the financial institution get to know the customer better, rather than just verifying their identity. They begin with CIP and go deeper with CDD and EDD.

Know Your Business (KYB)

Similar to Know Your Customer, Know Your Business is a process of vetting potential business partners, vendors, and clients. It follows a similar path to KYC and attempts to verify the identity of key players in the business and determine whether the company is involved in any illegal activity, such as money laundering, corruption, or fraud. It involves the following steps:

Bank Secrecy Act (BSA) and Financial Action Task Force (FATF) Recommendations

The Bank Secrecy Act, enacted in 1970, provides a framework for financial institutions to implement money-laundering prevention practices into their daily operations. One requirement is to monitor transactions over $10,000 and file regular suspicious activity reports (SARs) to the government and IRS. The Bank Secrecy Act regulations are implemented by various federal agencies, including the Financial Crimes Enforcement Network (FinCEN), the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency (OCC).

The FATF is an independent intergovernmental body that sets international standards for combating money laundering, terrorist financing, and financing weapons of mass destruction. The FATF recommendations are the global AML/CFT standard. The FATF promotes adopting and implementing its standards worldwide, including through mutual evaluations of countries. It also monitors countries' progress in implementing the FATF standards and reviews money laundering and terrorist financing techniques and countermeasures.

The bottom line is that the BSA is a U.S. law that implements many FATF recommendations. The FATF standards are considered the international benchmark for AML/CFT, and the BSA plays a key role in ensuring the US complies with these standards. Financial institutions must have AML/CFT programs consistent with the BSA and FATF recommendations.

Key Components of an AML Compliance Program

A robust AML compliance program will help fight against financial crime and money laundering. A typical AML compliance program consists of a few key components, and they are as follows:

Identifying and Reporting Suspicious Activity

One of the most essential aspects of ALM compliance is identifying and reporting suspicious activity. Banks and other financial institutions use Suspicious Activity Reports (SARs) to document these activities and report them to governing agencies like the FinCEN.

It begins with the financial institution identifying the suspicious activity or transaction. It may be a pattern of transactions that raises red flags and indicates possible involvement in illegal activities such as tax evasion, money laundering, or terrorist financing. Some indicators are unusual transaction sizes or frequencies, geographic anomalies, inconsistent transactions, complex patterns, and anonymous payment methods like cryptocurrency. Some examples of suspicious activity are:

Banks implement regular AML audits to identify these patterns or red flags. They have 30-60 days to report these findings to the regulatory agency responsible. The timeline is crucial for the government to follow up and perform a thorough investigation. Compliance with AML and the U.S. Patriot Act is mandatory for financial institutions.

Implementing a Risk-Based Approach (RBA)

Banks and other companies must implement a risk-based approach to AML compliance. A risk-based approach involves a deep commitment to AML and a robust risk identification, assessment, mitigation, and continuous monitoring procedure. The essential components of a risk-based approach are KYC/CDD and applying due diligence to every potential relationship. Additionally, real-time transaction monitoring and adverse media screening are used to identify customers associated with illegal activity in the news. The key steps in a risk-based approach to AML compliance are:

When dealing with risk, companies have a few different options, including avoidance, mitigation, acceptance, and transference.

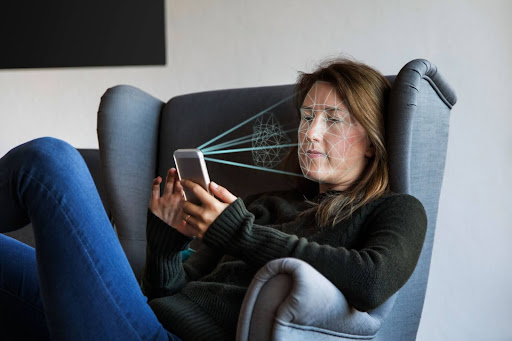

Leveraging Technology and Tools for AML Compliance

AML compliance is a complex set of rules requiring many different steps and techniques for gathering information, assessing risk, monitoring transactions, and mitigating risk. Making things even more complicated are ever-evolving regulatory requirements, which companies must keep up with. Many industries have chosen to leverage technology tools to make AML compliance quicker, more efficient, and more accurate. Some of the options used by anti-money laundering compliance programs are:

ENHANCED CUSTOMER DUE DILIGENCE

TRANSACTION MONITORING AND SUSPICIOUS ACTIVITY DETECTION

SANCTION SCREENING AND WATCHLIST MONITORING

Technology tools can automatically screen sanction lists and watchlists worldwide, ensuring international regulation compliance and instantly identifying customers who appear on these lists. These tools can then notify the proper authorities.

REGULATORY REPORTING AND COMPLIANCE

AI can also automatically create Suspicious Activity Reports (SARs) and other compliance documentation when an issue is identified. Time is of the essence, and these tools ensure compliance with timelines. Many of these tools can also integrate seamlessly with AML compliance databases to keep policies and procedures updated automatically.

LEVERAGING EMERGING TECHNOLOGIES

Some tools also explore the potential to expand transparency and financial transaction tracing to technologies like cryptocurrency. Many AML compliance platforms are cloud-based, enhancing scalability, flexibility, and cost-effectiveness.

Some of the benefits of using AI, machine learning, and technology tools in the fight against money laundering include:

By embracing technology, financial institutions can strengthen their AML compliance programs and keep up with the evolving regulations and criminal landscape to protect themselves against money laundering and other financial crimes.

Consequences of Non-Compliance

Non-compliance with AML regulations can be very costly to a business, not just financially but in other, more significant ways. Some of the more serious consequences are steep fines, criminal charges, restrictions, government monitoring, and reputational damage. In detail, the consequences of AML non-compliance are:

Poor AML compliance can also unknowingly aid criminals in money laundering and terrorist financing.

Building a Sustainable AML Compliance Culture

Building a sustainable AML compliance culture is a long-term prospect. It’s about making AML compliance a core component of the entire company. It’s not just skin deep; it must touch every aspect of the business’s operations, goals, policies, and procedures. Developing a proactive approach to AML compliance is a win-win for everyone—except the criminals. Building a culture of compliance begins at the leadership level. Some of the ways leaders can ensure AML compliance throughout the company are:

How EntityCheck Can Help AML Compliance

Before developing any business relationship, you want to avoid companies that engage in illegal activities like money laundering or have serious financial issues. The most prudent way to assess risk is through data. The more you learn, the better off you will be. EntityCheck’s primary goal is to collect business data, providing you with everything you need to know to assess and mitigate risk and take action.

EntityCheck delivers comprehensive business data that we have compiled from government, public, and private sources. Our reports include multiple sections with dozens of data points. You’ll find detailed Secretary of State records, such as Articles of Incorporation, annual filings, ownership changes, and entity classifications. UCC filings that cover equipment, vehicles, inventory, accounts receivable, and real estate. License status and expiration details are included if a business requires professional licensing, such as in law, real estate, dentistry, or skilled trades. Court-related data is also available, including lawsuits, bankruptcies, liens, judgments, and federal cases. You can also see information about trademarks, patents, company officers, employees, and their background information.

EntityCheck reports include data in the following categories:

Try a FREE EntityCheck business search today and discover insights about a company that you won’t find anywhere else.

- What is Money Laundering?

- What is Anti-Money Laundering?

- The History of Anti-Money Laundering

- What is Anti-Money Laundering (AML) Compliance?

- Why AML Compliance Matters

- AML Compliance Core Requirements (KYC, CDD, EDD)

- BSA and FATF Recommendations

- Key Components of an AML Program

- Identifying and Reporting Suspicious Activity

- Implementing a Risk-Based Approach (RBA)

- Leveraging Technology and Tools

- Consequences of Non-Compliance

- Building a Sustainable AML Culture

- How EntityCheck Can Help AML Compliance