What is a Credit Score/Report?

- What is a Business Credit Score/Report?

- What is a Business Credit Score?

- Benefits of a Good Credit Score

- Difference Between a Personal and Business Credit Score

- Do Personal Credit Scores Affect Business Credit Scores?

- How a Business Credit Score is Calculated

- How Long Does Negative Data Stay on a Business Credit Report?

- How New Companies Establish Business Credit

- How to Check a Business Credit Score

- Who Reports a Business Credit Score?

- What Information Can You Find in a Business Credit Score Report from EntityCheck?

A business credit score indicates the business's financial health and clearly indicates how well the company is doing. Knowing how to check a company's business credit score is essential for due diligence. A higher score indicates the company is financially responsible; a low score may mean staying clear is a good idea.

What is a Business Credit Score?

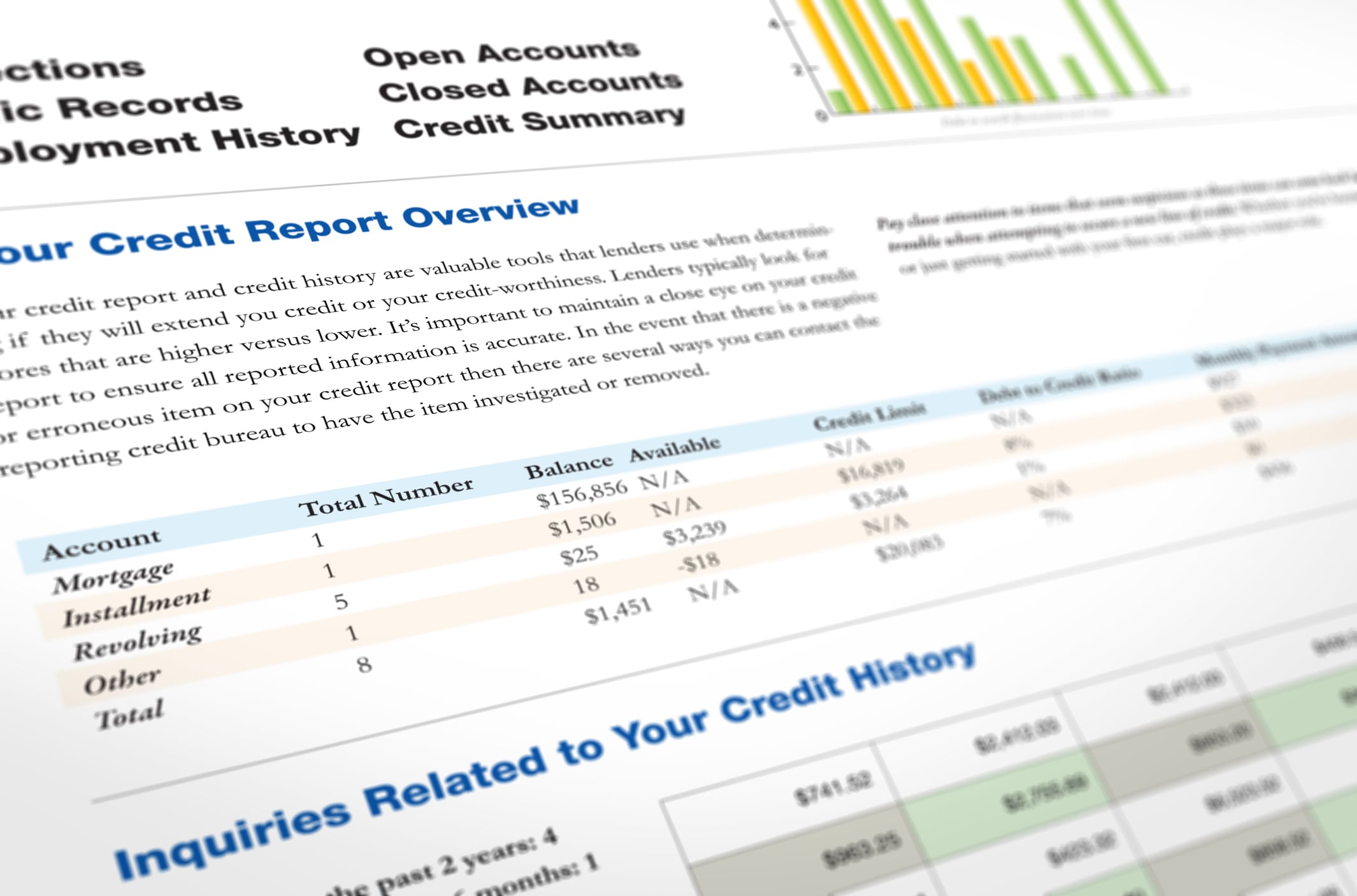

A business credit score is a numerical calculation that determines the business's creditworthiness. Lenders use this score to decide whether to loan the business money or extend credit. Vendors and partners will also want to know that a company has a good business credit score before doing business with them.

A business credit score indicates how well a company makes its payments to suppliers, creditors, and others. It includes their payment history, liens, and any bankruptcies filed. Banks use it to evaluate the risk of doing business with companies. You may also hear it referred to as a 'commercial credit score.'

Benefits of a Good Credit Score

Businesses that have good, strong credit, just like people, will earn benefits for being financially responsible. Some of the benefits you will enjoy as a business with good credit include:

Difference Between a Personal and Business Credit Score

Although personal and business credit scores work similarly, there are also some crucial differences between them. Personal credit scores start at 300 and go up to 850, whereas business scores start at zero and go up to 100.

Anyone can check a business credit score, but personal credit scores are private and only accessible by authorized entities.

Business credit scores are calculated using criteria different from personal credit scores. A business credit report uses your business EIN, which is associated with all your accounts, rather than your personal social security number, which is associated with your personal credit report and individual debts.

Typically, no. A company owner's personal credit does not affect their business credit scores except with the FICO SBSS report. That entity includes personal credit history in the mix when calculating its business score. Therefore, a company owner could have poor personal credit while still having excellent business credit.

Do Personal Credit Scores Affect Business Credit Scores?

Typically, no. A company owner's personal credit does not affect their business credit scores except with the FICO SBSS report. That entity includes personal credit history in the mix when calculating its business score. Therefore, a company owner could have poor personal credit while still having excellent business credit.

How a Business Credit Score is Calculated

A business credit score is calculated based on a few different data points. Credit bureaus collect information from banks, vendors, credit card companies, marketing databases, collection agencies, public records, and business trade associations to create a profile about the business. Each credit reporting agency uses a different calculation to score each business, but the general criteria they use are:

A complete credit report may contain additional information gathered from other sources. The credit reporting agency uses all these factors to determine a company's business credit score. Scores may land anywhere from 0 to 100. The higher the score, the better the credit is and the lower the risk. Typically, a score of 75 or above is considered 'Excellent.' Other risk score ratings are:

However, these risk tolerance levels vary based on the individual credit reporting agency.

How Long Does Negative Data Stay on a Business Credit Report?

Like personal credit, harmful data can stay on a company's business credit report for years, affecting its ability to get financing and desirable vendor terms. Experian claims it uses 'industry standard' terms to retain negative credit report information. Those standards are as follows:

How New Companies Establish Business Credit

A new business will not have any business credit until it takes out loans, applies for credit cards, or develops vendor relationships. New businesses will begin building a credit history by doing the following:

- Setting up a company as an LLC or Corporation, which requires an EIN. Credit agencies will then see it as a corporate entity.

- Apply for an EIN with the IRS.

- Open a business bank account using the legal company name.

- Establish a business phone line.

- Apply for a business credit card and use it sparingly.

- Take out loans as needed.

- Pay all their bills on time, according to the terms.

How to Check a Business Credit Score

Some reasons to check a company's business credit score are before partnering with them, allowing them to become a customer, conducting due diligence, or for legal purposes. Pulling a business credit report can fill in many blanks and provide you with the complete picture.

You can request a free copy of your own report from any of the three major business credit bureaus. However, you must pay a fee when requesting a copy of another company's report. Free business credit reports are limited; they don't contain much information. Each of the three agencies has different pricing packages. For example, a free Equifax business credit report will contain basic information, such as alerts about changes in the company information, but may lack deeper insights about the company's financial situation. Some of these services offer subscription services, while others allow you a set number of searches/reports. Depending on your package, a Dun and Bradstreet business credit report may also include credit monitoring, ratings, historical trends, dark web monitoring, and analytical tools. The package you choose will dictate the options you receive.

Along with the major credit bureaus, you can also use powerful commercial tools like EntityCheck to access a comprehensive business credit report that provides you with all the financial information you need and related business details. This information is invaluable for making informed decisions about doing business with a potential partner, customer, or legal opponent.

Who Reports a Business Credit Score?

Three main credit reporting agencies collect and analyze business credit data: Dun and Bradstreet, Equifax, and Experian. Each bureau uses its own ranking scale and informs creditors and vendors about a company's creditworthiness and the likelihood of paying bills on time. A fourth from The Fair Isaac Corp., the FICO Small Business Scoring Service (SBSS), also exists. However, this model calculates scores using information from the other three bureaus. It does not collect information on its own or issue business credit reports.

What Information Can You Find in a Business Credit Score Report from EntityCheck?

Now that you know how to check a business credit score, you can use the information to maximize your potential by engaging with other companies armed with all the facts. Consider also using a business EntityCheck report to look into other companies before supplying or partnering with them on projects. With an EntityCheck business background report, you get so much more than you do with any free options. Along with basic company information, you get deep insights into the company and related information you may not find anywhere else. Some of the data points you see include:

Run a free business credit report today with EntityCheck and learn more about a company than you thought possible.

- What is a Business Credit Score/Report?

- What is a Business Credit Score?

- Benefits of a Good Credit Score

- Difference Between a Personal and Business Credit Score

- Do Personal Credit Scores Affect Business Credit Scores?

- How a Business Credit Score is Calculated

- How Long Does Negative Data Stay on a Business Credit Report?

- How New Companies Establish Business Credit

- How to Check a Business Credit Score

- Who Reports a Business Credit Score?

- What Information Can You Find in a Business Credit Score Report from EntityCheck?