Social Purpose Corporations (SPC) and Public Benefit Corporations (PBC)

- Social Purpose Corporations (SPC) and Public Benefit Corporations (PBC)

- What is a Social Purpose Corporation or a Public Benefit Corporation, and How Do They Differ?

- Key Features of a Social Purpose Corporation/Public Benefit Corporation

- What Are the Best Types of Businesses to Operate as a Social Purpose Corporation?

- How to Register a Social Purpose Corporation

- What Are the Key Advantages of a Social Purpose Corporation?

- What Are the Key Disadvantages of a Social Purpose Corporation?

- Partnership vs. Sole Proprietorship vs. LLC vs. Standard Corporation vs. Social Purpose Corporation

- How is a Social Purpose Corporation Taxed?

- Pros and Cons of Social Purpose Corporation Taxation

- How to Convert a Social Purpose Corporation

Although social purpose corporations (SPCs) and public benefit corporations (PBCs) are not strictly the same, they share many similarities and must fully understand its benefits and drawbacks.

Although there is no tracked count of social purpose and public benefit corporations, experts estimate there are more than 10,000 of these entities in the United States. Both public benefit and social purpose corporations fall under the same umbrella of social purpose corporations, which aim to do social good while also making a profit.

These types of business entities offer flexibility and some unique features. Social purpose corporations have many pros and cons you must be aware of before establishing one. Further down this page, you can learn about what a social purpose corporation/public benefit corporation is, how it works, how they are taxed, and the unique features and benefits of a social purpose corporation.

What is a Social Purpose Corporation or a Public Benefit Corporation, and How Do They Differ?

A social purpose corporation (SPC) is a for-profit organization that aims not only to generate a profit but also has a legally stated social purpose to improve the lives of everyone. It’s a hybrid business structure that combines the financial goals of a traditional corporation with the social mission of a nonprofit. Social purpose corporations must explicitly outline their social purpose in their Articles of Incorporation. SPCs are required to produce an annual report that includes financial statements and a management discussion and analysis of their social purpose activities. Directors of an SPC have more flexibility in allocating resources to pursue the social purpose, with less fear of legal repercussions from shareholders. SPCs offer a balance, allowing businesses to pursue both financial and social goals within a for-profit framework.

A public benefit corporation (PBC) is a type of for-profit corporation that is legally required to consider the interests of all its stakeholders beyond just shareholders, including the public good, and report on its social and environmental impact. Essentially, it's a way for businesses to pursue both profit and a positive social or environmental mission.

Key Differences Between the Two Types

Both a social purpose corporation and a public benefit corporation are legal structures for businesses that want to prioritize social or environmental good while making a profit. They differ in their specific requirements and obligations. For example, in Washington State, SPCs have more flexible requirements for pursuing their purpose. In contrast, PBCs have a more well-defined “general public benefit,” and they must undergo a third-party assessment each year.

| Public Benefit Corporation (PBC) | Social Purpose Corporation (SPC) |

|---|---|

| PBCs are legally obligated to pursue a general public benefit, meaning they must generate a positive impact on society and the environment as a whole. They may also pursue specific public benefits in addition to the general focus. | SPCs, like in Washington state, can pursue specific social or environmental purposes, as defined in their Articles of Incorporation. |

| PBCs are required to have their social and environmental performance assessed and reported on by a third-party organization. | SPCs have far less strict reporting and assessment requirements and do not require any third-party assessments. |

| PBCs also have strict legal provisions that ensure accountability in regards to their stated social and environmental goals with reporting requirements and potential consequences if they do not meet the goals. | SPCs offer more flexibility to directors so they can more easily balance social and financial goals in how they pursue their chosen good. |

| PBCs are available in 30 states, including Arizona, Delaware, Maryland, Nevada, and Utah. | The social purpose corporation status is currently only available in Washington, Florida, and California. |

In summary, PBCs are designed for businesses with a broad commitment to doing good in the world and making a positive difference, as opposed to SPCs, which require clearly defined goals and demonstrated performance towards them.

Key Features of a Social Purpose Corporation/Public Benefit Corporation

Some of the key features of these unique types of corporate entities include:

- Dual Fiduciary Duty:

Unlike traditional corporations, where directors primarily focus on maximizing profits and shareholder value, PBC/SPC directors have a dual fiduciary duty. They must consider both the financial interests of shareholders and ensure that the company achieves its social and environmental goals as well.

- Specific Public Benefit Purpose:

PBCs/SPCs are legally required to identify and pursue at least one specific public benefit in their formation documents, such as environmental sustainability, community development, or advancement of the arts.

- Transparency and Accountability:

PBCs must publish annual benefit reports that detail their progress toward achieving their stated public benefit goals. SPCs are not required to report on their progress.

- For-Profit Structure:

PBCs/SPCs are for-profit entities, not nonprofits. This means they can raise capital through various means, including selling stock, and can engage in profit-generating activities. They are also taxed as for-profit entities.

What Are the Best Types of Businesses to Operate as a Social Purpose Corporation?

Social purpose corporations are for-profit companies that generate a profit while also contributing to the betterment of the world through their operations. The best types of businesses for this type of structure are those that prioritize social and environmental impact alongside financial success. Additionally, businesses with innovative, non-traditional models that address social or environmental issues are also good candidates.

Some examples are:

- Social Mission:

Companies that provide affordable, healthy meals to low-income communities are a good example. Or, one that utilizes sustainable practices in manufacturing and supports fair trade practices. A company that offers job training or placement services for individuals with barriers to employment is also a good example.

- Clean Technology:

Businesses that focus on renewable energy (e.g., solar), energy efficiency, and sustainable resource management are examples.

- Health:

Organizations that provide access to affordable healthcare, mental health services, or wellness programs work well as SPCs.

- Education:

Any company that offers educational resources, tutoring, or vocational training.

- Micro-Finance:

Companies that offer financial services to underserved communities also qualify.

- Environmental Sustainability:

Businesses that focus on waste reduction, recycling, or sustainable agriculture.

- Subscription Box Services:

Companies that offer curated boxes with ethical, sustainable, or socially conscious products.

- Fee-for-Service Models:

Charging customers directly for socially beneficial services.

- Buy One, Give One:

Partnerships that align with a nonprofit and donate a portion of sales to a charitable cause.

- Community-Supported Agriculture (CSA):

Providing fresh, locally grown food to members of a community.

SPCs and PBCs typically provide benefits, training, and opportunities for their employees, prioritizing employee well-being and success. These same companies typically implement eco-friendly practices across all aspects of their business.

Who Is Eligible to Operate as a Social Purpose Corporation in the US?

In the U.S., any for-profit company can choose to operate as a social purpose corporation or public benefit corporation. The rules are state-level, so you must register in the state where it is permitted and then comply with all state regulations.

How to Register a Social Purpose Corporation

To register a social purpose corporation, you must complete several steps. They are as follows:

1. Determine Your Eligibility

First, you must determine whether your organization can become a social purpose corporation or a public benefit corporation. Check with the Secretary of State or your state’s licensing board to find out. Along with finding out if you can be an SPC/PBC, review the regulations and determine whether or not you can easily comply with them.

2. Incorporate Your Organization

Next, you must incorporate your organization through the Secretary of State or another agency responsible for business filings. Social purpose corporations/public benefit corporations are essentially corporations. Follow each of the steps below to do that.

3. Choose a Business Name

As with any business, the first step is to choose your business name. Keep the name simple, impactful, and related to your business purpose. Don’t choose a name that is too long or hard to remember or spell. The goal is to make it easy for your patrons to find you and remember your name. Comply with other state rules regarding naming.

Check with your Secretary of State to ensure the name is available for registration. You cannot use an existing name or one close to your chosen business name. Also, check the U.S. trademarks database to see if your proposed company name is already there. You do not want to infringe on anyone’s trademark.

4. Select Your State of Nonprofit

You can incorporate your SPC/PBC only within certain states in the U.S. Take some time to learn about the corporate laws, taxes, and fees to find a state that works best for you. Consider how easy or hard it is to incorporate in that state and how much it will cost. Some states offer a more business-friendly environment.

5. Draft and File Articles of Incorporation

Have an attorney draft your Articles of Incorporation, which should include the company’s name, purpose, and structure. File the completed and signed Articles of Incorporation with your state agency, which is most often the Secretary of State. Consult with your state agency and comply with the specifics in your state. These Articles of Incorporation must include your legally stated and social purpose. Some states have a specific form that must be filled out for this part.

6. Draft & File Corporate Bylaws

Along with your Articles of Incorporation, have your lawyer draft your corporate bylaws detailing the operational rules of your SPC/PBC business, including membership requirements, duties, responsibilities, and procedures. Ensure that your bylaws comply with all federal and state laws.

7. Register with the IRS for an EIN

You should also obtain an EIN to file wage reports and other tax documents required by the IRS. This crucial step is easy to accomplish. Log onto the IRS.gov website, register your social purpose corporation/public benefit corporation, and get an EIN within a few days. You will need this EIN when you apply to open a business bank account.

8. Obtain Business Insurance

Find a corporate business insurance agent and purchase policies that protect you against catastrophic financial loss in case of legal issues or other problems. You will also need commercial auto insurance if you use vehicles in your business.

9. Apply for a Bank Account(s)

Apply for as many business bank accounts as you need to keep all business activities in one place. According to corporate laws, you must keep the nonprofit’s money separate from any board member’s or director’s.

10. Licensing

Ensure that each corporation owner holds a valid and up-to-date license issued by the state in their chosen profession. These licenses are crucial for qualifying and maintaining the legality of your business.

11. Choose a Registered Agent

You must choose a registered agent for the corporation. This person or entity will be the legal point of contact and receiver of any legal documents and correspondence sent to the corporation.

12. Consider B-Corp Certification

While not legally required, you can also pursue voluntary B Corp certification from B Lab. This involves a rigorous assessment of your company's social and environmental performance. There are tremendous benefits to B-Corp certification.

13. Shareholder Meeting

Once your corporation is fully formed, you can hold your first shareholder meeting with all the owners. During the meeting, the initial “incorporators” will discuss the business plan and other topics of interest. The first order of business should be to discuss, approve, or amend the bylaws and discuss your business plan.

14. Register for State Filings

Your business may be required to file regular reports to a state agency. You may also be required to register with the state Attorney General’s office. Follow all state-level guidelines and file reports when necessary. Check with your state tax office to learn more about this step. Most states require public benefit corporations to publish an annual benefit report assessing their social and environmental performance, often using a third-party standard. This report is typically sent to shareholders and made publicly available. SPCs do not have this same standard.

15. Secure Funding and Recruit Members

Explore financing options and secure funding to support the business for at least the first year. This may include taking out loans or asking new members to join and invest in the company.

What are the Key Advantages of a Social Purpose Corporation?

All types of business structures come with advantages and drawbacks. Social purpose and public benefit corporations are no different. Some of the key advantages of these types of business entities include:

What Are the Key Disadvantages of a Social Purpose Corporation?

Along with the multitude of positive reasons to organize your company as a social purpose or public benefit corporation, there are also some negatives. The key disadvantages of a social purpose corporation or public benefit corporation are:

Partnership vs. Sole Proprietorship vs. LLC vs. Standard Corporation vs. Social Purpose Corporation

A social purpose corporation or public benefit corporation differs significantly from other business entities, but still retains some of the characteristics of a corporation. Review the chart below to learn about the different types of business formations and how they compare to see which structure makes the most sense for your company.

| Characteristic | Sole Proprietorship | Partnership | LLC | S-Corp | Nonprofit (C-Corp) |

|---|---|---|---|---|---|

| Formation | Quick and simple with no filing requirements with any government agency. | Simple to create with no legal filing requirements. | More expensive to create and requires filing with the state. | An S-Corp is more costly to establish, and it requires state filing. | It is more expensive to establish and requires filing with the state. |

| Cost of Formation | None | None | The cost of the state filing fee is usually between $100-$150. | The cost of registering an S-Corp with the state can be anywhere between $20 and $800. | The average cost to register a C-Corp in the United States is $633. |

| Business Name | Can operate under the owner’s name, or a fictitious name using a DBA. | Can operate under the owner’s name, or a fictitious name using a DBA. | Must register an official company name with the state that is established and secured. | Must register an official company name with the state that is established and secured. | Must register an official company name with the state that is established and secured. |

| Taxation | Pass-through taxation, where all everything is filed under the owner’s personal taxes. | Filed under the partners. Each partner claims their income and losses on their personal returns based on their percentage of the business. | Pass-through taxation, where everything is filed under the owner’s personal taxes. If there are multiple owners, taxation is treated like a nonprofit. | Each owner declares their share of profits/losses on their personal returns. Income is allocated based on owner percentage. Owners can use corporate losses to offset other types of income. Fringe benefits are limited to owners who own more than 2% of the shares. | The C-Corp is a separate taxable entity that must file returns. Owners split profits and only declare their portion on personal income tax returns. Owners can deduct fringe benefits as business expenses. |

| Liability | The owner is personally liable for all business actions, liabilities, debts, and damages. | Owners are personally liable for all business debts. | Business is its own entity; therefore, the owner(s) are protected against personal liability. | Owners have limited liability for personal debts, and business legal issues. | Owners have limited liability for personal debts and business legal issues. |

| Operational Requirements | No operational requirements are necessary. | No operational requirements are necessary. | More formal requirements than an LLC but not as strict as a C-Corp. | Much easier to maintain than a nonprofit. Annual member meetings and a report are required. | Annual meetings are required, and members must vote on changes. Shares of stock must be sold to raise capital. |

| Management | Full control of all decisions, management, and operations. | Each partner has equal control and decision-making ability unless it’s a limited partnership. | An operating agreement outlines how each member can manage the company. | Managed by a group of directors that shareholders vote in. | Managed by a group of directors that shareholders vote in. |

| Raising Capital | Can be challenging and the owner often has to invest his/her own money. | Each partner can invest, and more partners can be added to raise additional capital. | Managers can sell interest in the business to raise capital based on operating agreement restrictions. | Can sell shares of stock to raise capital. | Can sell shares of stock to raise capital. |

| Transferability of Interest | No | No | Possible based on the operating agreement restrictions. | Yes, as long as IRS regulations about who can own stock are honored. | Shares of stock can be easily transferred. |

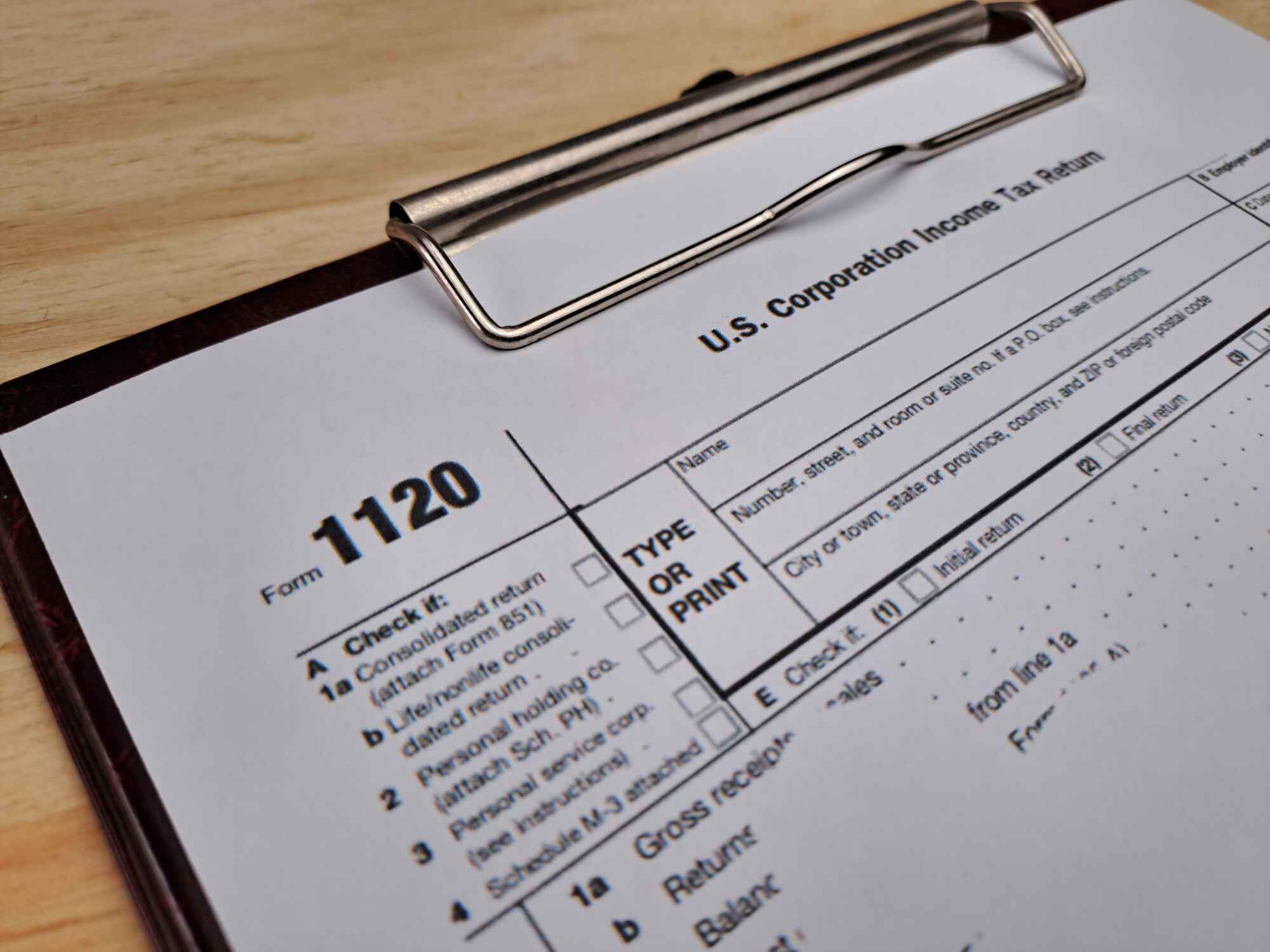

How is a Social Purpose Corporation Taxed?

Social purpose corporations and public benefit corporations are taxed exactly the same as traditional for-profit corporations. They are not eligible for tax-exempt status as a nonprofit organization, and they are generally treated as either C corporations or S corporations for federal tax purposes, depending on how the owners structure their affairs.

Public benefit corporations and social purpose corporations operate as for-profit entities designed to generate revenue and profits for their shareholders. That means they are subject to the same federal and state income tax laws as a standard corporation.

Some social purpose corporations that do not qualify for S corporation status (e.g., due to number of shareholders), will be taxed as a C corporation, meaning that the corporation itself will pay income tax on its profits, and shareholders who receive dividends will be taxed on those as well with their individual tax returns. C corporation status results in double taxation.

Social purpose corporations that have a limited number of shareholders (usually fewer than 100) and meet other specific requirements can elect to be taxed as an S corporation. This allows for “pass-through” taxation, and the corporation avoids corporate taxes. In this case, the shareholders report all profits and losses on their individual tax returns. It avoids double taxation.

Social purpose corporations are not eligible for tax-exempt status (like those under Section 501(c)(3) of the IRS code) because they are structured as for-profit entities.

While public benefit corporations are not tax-exempt, they may have some tax advantages related to charitable contributions if they make donations to qualifying non-profits.

In addition to federal taxes, SPCs and PBCs are also subject to state and local taxes, such as business and occupation taxes, sales taxes, and property taxes, just like any other business entity in that state.

Pros and Cons of Social Purpose Corporation Taxation

The pros and cons of social purpose or public benefit corporations depend on their structure. C corporations result in double taxation, which can be a negative consequence. However, it is typically calculated at a lower rate than individual tax rates, making it a potentially beneficial tax rate. S corporation status allows for pass-through taxation, where shareholders report all profits and losses on their personal tax returns. Depending on your perspective, this may be a pro or a con.

Use the table below from the IRS to be sure you are filing the correct forms when filing taxes:

How to Convert a Social Purpose Corporation

You may start out as a social purpose or public benefit corporation, and over time, circumstances may change, requiring you to convert to another type of business entity. Conversion is not to be taken lightly and requires several steps to accomplish.

Converting a Social Purpose Corporation to a Partnership

Only certain states allow SPCs and PBCs. Therefore, converting from an SPC or PBC is a complex process that may have profound legal and tax implications. Although rules vary widely from state to state, the general process for converting from a social purpose corporation to a partnership is as follows:

- Research state laws and learn precisely how to convert your social purpose corporation to a partnership. Each state may have different requirements.

- Complete and file your conversion document to initiate the process with the state agency responsible for corporations. You may convert to a domestic partnership or limited partnership.

- Hold a shareholder meeting and get approval from all members.

- Draft a new Partnership Agreement that makes the shareholders parties to the partnership’s governing documents.

- Liquidate the corporation.

- Distribute the social purpose corporation’s assets and liabilities to shareholders, who then contribute them to the new partnership.

- The deemed liquidation can be taxable, resulting in two levels of tax: corporate tax on the appreciated assets and tax at the shareholder level on the distributed assets.

- The new partnership will assume responsibility for filing tax returns and paying any tax liabilities associated with the dissolution of the corporation.

Converting a Social Purpose Corporation to an LLC

Converting a social purpose corporation or public benefit corporation to an LLC typically involves creating a new LLC and then transferring all the corporation’s assets and liabilities to it. Usually, you must also dissolve the SPC or PBC after converting. The general process looks like the following:

- Define the purpose of the new LLC and how it will better support the company’s goals.

- Assess the impact of making the change.

- Communicate with stakeholders and get formal approval for the conversion.

- Form a new LLC; choose a name, draft an operating agreement, outlining the ownership structure, management responsibilities, and operating procedures for the LLC.

- File the Certificate of Formation with the Secretary of State or other appropriate state agency.

- Identify all assets and liabilities (property, equipment, intellectual property, debts, contracts, etc.).

- Transfer the assets and liabilities to the newly formed LLC. You may need to create legal documents, such as deeds and legal contracts, to accomplish this.

- Once everything has been transferred, formally dissolve the corporation following your state’s laws.

- Ensure that all legal and financial records accurately reflect the LLC’s structure and ownership.

- Inform banks, vendors, and other relevant parties of the change in legal structure.

- Obtain any new licenses or permits required for the LLC to operate.

Converting a Social Purpose Corporation to a Standard Corporation

To convert a social purpose or public benefit corporation to a standard (or traditional) corporation, you'll generally need to amend your Articles of Incorporation and obtain shareholder approval. The specific process varies by state, but typically involves filing amended articles with the state's corporation department and potentially updating bylaws.

The process to convert from a social purpose corporation to a standard corporation is as follows:

- Each state has its own laws governing SPCs/PBCs and the process for converting to a standard corporation. You'll need to consult the specific statutes in your state (e.g., in Washington, it's Chapter 23B.25 RCW). Some states may require a name change as part of the conversion process, potentially requiring the removal of "Social Purpose Corporation" or "SPC" from the name.

- Identify and remove any provisions in your Articles of Incorporation that define the SPC/PBC status, such as statements about social or environmental goals or specific reporting requirements.

- Thoroughly review all other relevant sections of the Articles of Incorporation to ensure they are updated to reflect the standard corporate structure (e.g., removal of any references to social purpose, if applicable).

- The board of directors typically needs to recommend the conversion. Hold a vote to get everyone on board. Shareholders will need to approve the amendment to the articles of incorporation, often requiring a supermajority vote (e.g., two-thirds).

- File the amended Articles of Incorporation with the appropriate state agency (e.g., the Secretary of State). Be prepared to pay any required filing fees.

- Changing from an SPC or PBC can result in tax implications; consult a tax professional for assistance.

Check with your state office to review the specifics of corporate law and learn how to change your social purpose corporation into a new business entity to avoid potential legal issues in the future.

- Social Purpose Corporations (SPC) and Public Benefit Corporations (PBC)

- What is a Social Purpose Corporation or a Public Benefit Corporation, and How Do They Differ?

- Key Features of a Social Purpose Corporation/Public Benefit Corporation

- What Are the Best Types of Businesses to Operate as a Social Purpose Corporation?

- How to Register a Social Purpose Corporation

- What Are the Key Advantages of a Social Purpose Corporation?

- What Are the Key Disadvantages of a Social Purpose Corporation?

- Partnership vs. Sole Proprietorship vs. LLC vs. Standard Corporation vs. Social Purpose Corporation

- How is a Social Purpose Corporation Taxed?

- Pros and Cons of Social Purpose Corporation Taxation

- How to Convert a Social Purpose Corporation